The cold wind blew sharply through the downtown streets of New Haven as Evelyn Price pulled her gray wool coat tighter. She glanced up at the imposing stone facade of First Charter Bank, her heels clicking steadily against the marble steps as she climbed them. It was a Thursday afternoon, and the branch was quiet except for a couple of clients sitting in leather chairs near the waiting area.

Evelyn had no appointment. She didn’t need one.

She walked in holding a slim leather folder and a small purse, her presence poised but understated. No security entourage, no assistant, no grand entrance — just a woman in her late 40s with confidence in every step. She approached the front desk calmly.

“Good afternoon,” she said to the woman behind the counter, whose name tag read Tracy.

Tracy barely looked up from her computer. “Hi. Are you here to make a deposit?”

“No,” Evelyn replied evenly. “I’m here to speak with the branch manager.”

Tracy’s brows lifted in suspicion. She looked Evelyn up and down — neat, but not flashy. Certainly not someone she recognized. “Do you have an appointment?”

“No, but it’s important. I’d appreciate it if you could let the manager know I’m here.”

Tracy hesitated. Her eyes darted to Evelyn’s worn leather folder — no luxury logos, no business card held out, no air of urgency. Just a calm woman with a request. “Ma’am,” Tracy said, her voice cooler, “Our manager doesn’t meet with walk-ins. If you’d like to schedule an appointment, I can give you a number to call.”

“I assure you,” Evelyn said, the first trace of steel in her voice, “he’ll want to see me.”

Tracy gave a tight smile, the kind that barely touched the eyes. “And I assure you, ma’am, we’re quite busy. Perhaps another day?”

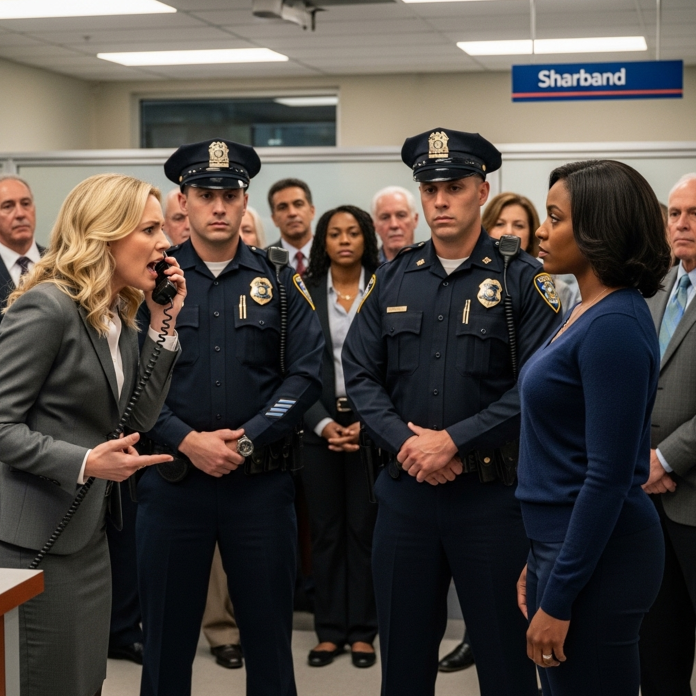

Evelyn said nothing. She simply stood there, letting the silence stretch until it became uncomfortable. Other employees started to glance up. A security guard shifted behind a glass partition.

“Is there a problem here?” A man’s voice called out from behind a frosted-glass door.

Marcus Bell, the branch manager, stepped forward, a tall man in his late 30s with a well-tailored suit and the air of someone who believed in the importance of titles. He glanced between Tracy and Evelyn with professional curiosity.

“This woman’s requesting to see you without an appointment,” Tracy said quickly.

Marcus turned to Evelyn. “Yes, and you are?”

“Evelyn Price.”

He gave her a polite, practiced smile. “And what’s the matter I can assist you with today, Ms. Price?”

Evelyn opened her folder, removed a small envelope, and held it out. “I think you’ll want to read this.”

He took the envelope but didn’t open it right away. “Ms. Price, I really am quite busy today, so if this is about an account or a transaction—”

“It’s not.”

He exhaled slowly and opened the envelope. It contained a single piece of official letterhead with the First Charter Bank crest at the top. His eyes scanned it once, then again. His expression didn’t change — but the color did drain slightly from his face.

“This… this must be a mistake.”

“It’s not,” Evelyn said quietly. “And I would appreciate a private room now.”

Marcus didn’t reply immediately. He motioned awkwardly to an associate. “Show Ms. Price to Conference Room B. Now.”

Tracy’s mouth had parted slightly. Her cheeks were flushed.

As Evelyn followed the associate, her phone buzzed. She glanced at it: a message from her assistant.

“Regional Director just confirmed. Entire C-suite briefing rescheduled to 4 PM. Internal compliance will join.”

Evelyn tapped out a simple reply: “Good. Let’s make this a teachable day.”

Two Hours Earlier…

Evelyn sat in her car across the street from the branch. She had just left a meeting with the regional board — part of her regular unannounced site visits. In her role as CEO of First Charter Bank, Evelyn believed deeply in understanding the customer experience firsthand. That meant sometimes going undercover, walking into her own branches anonymously, watching how customers were treated — especially those who didn’t look like they were wealthy or important.

She had founded the bank herself 17 years ago. A young Black woman with a background in finance and a stubborn belief that institutions should treat every customer with respect, regardless of appearance. Her bank had grown slowly at first, then explosively. By 2025, it was one of the top ten regional financial institutions in the country, with over 300 branches.

But rapid growth brought challenges — especially when it came to culture.

She had heard whispers: certain branches where clients were judged by the clothes they wore or the cars they drove. Where older women, minorities, or people without “obvious wealth signals” were treated with suspicion.

She had seen it before, in her own career — doors not opening, names being forgotten, decisions questioned.

That morning, she had decided to pay the downtown New Haven branch a personal visit. No limo, no announcements. Just Evelyn Price, the customer.

Back in the conference room…

Marcus was sweating. “Ms. Price, I—if I’d known—”

“You would’ve offered me water? Sat me down faster?” she asked, her tone even.

He faltered. “Of course not — I mean — we treat every customer the same.”

Evelyn raised an eyebrow. “Do you?”

She opened her folder again and laid out three photos on the table: security footage stills from earlier this week. A middle-aged woman in a janitor’s uniform being waved toward the ATM. A Hispanic father asking for a loan form and being handed a flyer instead. A young man being followed by the security guard for browsing brochures.

“These are just this week,” Evelyn said. “From your branch.”

Marcus’s face had gone pale. He said nothing.

“Tracy,” Evelyn said calmly, “will be placed on administrative review. And you, Marcus, will meet me tomorrow morning at HQ. We’ll be discussing branch culture, staff training, and bias screening.”

She stood up. “Dismissive behavior may seem small. But it adds up. And in this bank, we don’t dismiss people.”

She opened the door and walked out, leaving the entire branch in stunned silence.

But what happened next — after she left — would send shockwaves through not just the branch, but the entire organization…

By the next morning, word of what had happened at the New Haven branch had spread like wildfire.

Emails circulated. Slack threads exploded. Phone calls rang from floor to floor at First Charter Bank headquarters.

The CEO had gone undercover — again — and someone had made the mistake of treating her like she didn’t matter.

But this time, she hadn’t just walked out in silence.

She had left behind evidence. And she had a plan.

Friday, 9:00 AM — First Charter Headquarters, 26th Floor

Marcus Bell sat stiffly in a leather chair outside the executive conference room, his palms sweating despite the cool air of the towering office. The skyline of Hartford stretched behind him, but he didn’t see it. His mind was racing.

He’d barely slept. He’d rehearsed his apology a dozen times. He knew his job was on the line. But what he didn’t know was that this meeting wasn’t just about him.

Inside, the room buzzed with quiet tension.

Around the polished oak table sat the Chief Compliance Officer, Chief Human Resources Officer, and Director of Training & Development. Evelyn stood at the head of the table, calm and composed, holding a folder.

“Bring him in,” she said.

Marcus entered and froze. This was no one-on-one scolding. This was a tribunal.

He sat down slowly as Evelyn spoke.

“You’ve been with the bank six years, Marcus.”

“Yes, ma’am.”

“And your branch has consistently hit quarterly targets.”

“Yes.”

“But that’s not enough anymore,” she said. “Not when customers walk away feeling small. Invisible. Judged.”

She opened the folder and revealed a scorecard — a new tool quietly piloted at a few branches in the past quarter. It tracked not just transactions and sales, but customer sentiment, inclusivity audits, and behavioral indicators from both staff and security.

New Haven scored a 38 out of 100.

The worst in the region.

Marcus swallowed hard.

“This isn’t about one incident,” Evelyn continued. “It’s about patterns. You’ve let a culture grow where certain people — based on appearance, accent, or economic background — get treated differently. That’s not a bank. That’s a gate.”

“I… I didn’t realize,” Marcus said, voice low. “I failed to see it happening under my watch.”

“You didn’t fail to see it,” Evelyn said sharply. “You chose not to. You saw who got followed. Who got ignored. Who got interrupted mid-sentence. And you didn’t stop it.”

Silence.

“I’m giving you two options,” she said. “One — you resign today, and we part ways. Or two — you stay, but you start over. You’ll be on probation. You’ll undergo cultural competency training, customer empathy workshops, and you’ll mentor under the VP of Community Relations for the next 60 days.”

Marcus looked stunned. “You’d let me stay?”

“I believe in accountability. But I also believe in transformation. The question is: do you?”

He looked down, then back at her. “I do. I want to do the work.”

Evelyn nodded once. “Then get ready. It won’t be easy.”

Meanwhile, at the New Haven branch…

Tracy was at her desk, unsure what the future held. She’d been placed on administrative leave pending review — but instead of sitting at home, she’d asked if she could volunteer during the new community open house happening that day.

It was part of Evelyn’s plan.

Within 24 hours of the incident, a team from HQ had transformed the lobby of the branch. Gone were the cold, distant vibes. In their place were new signs reading:

“Everyone Welcome. Every Story Matters.”

“No Appointment Needed. Just Come As You Are.”

“Real Banking for Real People.”

The walls had new art from local schools. The coffee station offered drinks and pastries from minority-owned bakeries in the neighborhood. Staff stood at the door — not behind counters — greeting each person with a smile.

Customers streamed in. Curious. Some skeptical. Others just grateful.

One older woman, clutching a purse and a paper check, looked around wide-eyed.

“I haven’t felt this seen in a bank in years,” she whispered to a teller. “Not since my husband passed.”

The teller smiled and walked her over personally to a private desk. “Let’s sit down together.”

That day, the branch didn’t just make deposits — it made connections.

One Week Later — Company-Wide Livestream

Evelyn stood in front of a camera broadcasting to over 10,000 employees.

She told the story — truthfully, powerfully, and without sugarcoating.

She showed clips from the lobby camera. She described what it felt like to be dismissed. She reminded them that titles don’t define worth — and wealth doesn’t determine dignity.

“We are not in the business of protecting money,” she said. “We are in the business of protecting people. All people.”

She announced the launch of a company-wide initiative: Project Open Door.

Every branch would undergo surprise empathy audits. Staff would complete immersive customer experience training. Every manager would be held to new cultural integrity standards.

And most boldly of all — Evelyn committed to doing one anonymous visit every month, to a random branch, anywhere in the country.

“This is not about fear,” she said. “It’s about remembering who we serve.”

Six Months Later…

The New Haven branch had become a case study.

Marcus — still managing, but now transformed — led diversity training sessions for new hires.

Tracy, after completing a mentorship program, returned as a Customer Experience Leader, focusing on serving underserved demographics.

The branch’s inclusivity score? 91 out of 100.

Customers talked about “that bank that actually listens.” Local media covered the turnaround. Community leaders started new partnerships. And through it all, Evelyn stayed the same — firm, humble, and always watching.

They had refused her service that day — because they didn’t know who she was.

But more importantly, they didn’t know what she stood for.

Now?

They did.

And so did the entire nation.