I stared at the bank teller as her hands shook. “Sir… this account has been investing for forty years,” she whispered. My heart pounded. Fired at 56, broke, humiliated—this was supposed to be my end. Then she turned the screen toward me. Berkshire Hathaway. I laughed under my breath. All those years… while I struggled, someone had been quietly preparing my reckoning. And that was only the beginning.

Part 1 – The Day Everything Collapsed

I worked seventy-hour weeks for twenty-two straight years to build someone else’s empire. My name is Michael Turner, and for most of my adult life, the restaurant business was everything I knew. I started as a dishwasher at twenty-four and climbed my way up—shift manager, operations director, regional supervisor. I missed birthdays, funerals, even my own wedding anniversary, all to make sure the numbers were right and the kitchens ran smoothly.

At fifty-six, my boss, Richard Cole, called me into his glass-walled office. He didn’t offer a seat.

“You’re too old,” he said bluntly. “The industry needs fresh energy.”

That was it. No thank you. No severance worth mentioning. Just a handshake that felt like an insult.

I walked out carrying a cardboard box with my mug, a framed photo of my parents, and twenty-two years of loyalty reduced to nothing. I went home numb, calculating how long my savings would last. The answer scared me.

The next morning, desperate, I went to my childhood bank branch—the one my parents opened an account for me in back in 1986. I remembered my father depositing twenty dollars and telling me, “Don’t touch this. Time will do the work.” I never questioned it. Life got busy.

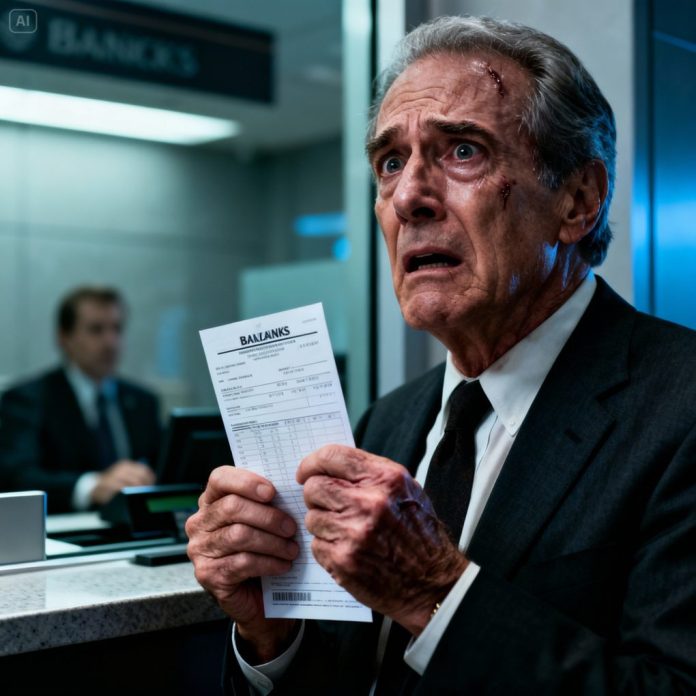

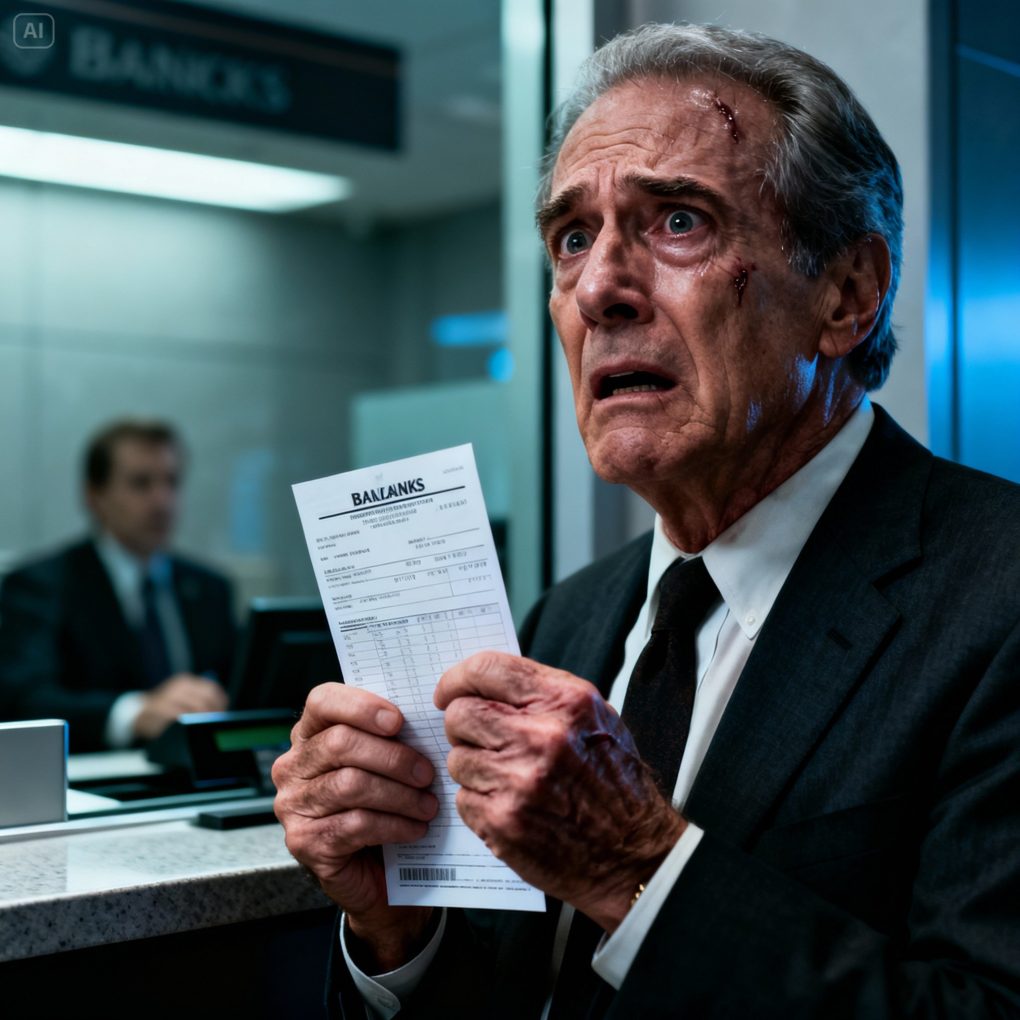

At the counter, I asked the teller to check the balance.

She froze.

“Sir… may I ask you to wait a moment?”

When she came back, her hands were shaking. She printed a statement and slid it across the counter.

“This account has been enrolled in an automatic stock investment plan… for forty years.”

I scanned the page.

Then I saw the words that made my chest tighten: Berkshire Hathaway.

The balance didn’t make sense. It couldn’t be right.

“There’s been a mistake,” I whispered.

She looked me straight in the eyes. “There hasn’t.”

That was the moment everything I thought I knew about my life cracked open—and just as I began to understand what my parents had quietly done, my phone buzzed.

It was Richard.

“Michael,” he said casually, “I might have something to discuss.”

I stared at the number on the paper again… and realized the conversation was about to change forever.

Part 2 – The Truth My Parents Never Explained

I didn’t call Richard back immediately. For the first time in decades, I didn’t react on impulse. I went home, sat at my kitchen table, and spread the bank documents out like evidence at a crime scene.

The numbers were real.

My parents—Thomas and Evelyn Turner—had quietly converted that childhood savings account into a long-term automatic investment plan. They never touched it. Never borrowed from it. Never mentioned it. Dividend reinvestments. Stock splits. Compound growth doing what it does best—over time.

I drove straight to their house.

They were older now, slower, surprised to see me on a weekday afternoon. My mother looked nervous the moment she saw my face.

“You went to the bank, didn’t you?” my father asked.

I placed the statement on the table.

“You could’ve told me.”

My mother sighed. “We didn’t want it to change you.”

My father leaned back. “We wanted you to build something on your own. That money wasn’t a rescue rope—it was a foundation. Only if you needed it.”

I laughed bitterly. “I needed it years ago.”

“No,” my father said calmly. “You thought you did.”

That night, I didn’t sleep. I ran the numbers, spoke with a financial advisor, and realized something unsettling: I didn’t need another job. I needed a strategy.

Two days later, Richard showed up at my door.

He looked different—less confident.

“I may have been hasty,” he said. “The board’s struggling. The expansion failed. We could use someone with your experience.”

I smiled.

“You fired me because I was ‘too old,’” I replied. “What changed?”

He hesitated. “We’re offering equity.”

That was when I understood the shift in power.

I declined politely.

Instead, I quietly acquired a minority stake in one of his largest locations—through a holding company. He didn’t know it was mine. Yet.

Over the next six months, I studied. I watched. I invested carefully. I didn’t announce my success. I didn’t buy flashy cars or post online. I let silence do the talking.

Then the call came.

Richard’s company was drowning in debt.

And he needed help.

Part 3 – When the Tables Turned

Richard asked to meet.

We sat across from each other in a neutral office downtown. No glass walls this time. No power posturing.

“I hear you’ve done well,” he said carefully.

“I hear you haven’t,” I replied.

He explained the situation—rising costs, bad expansion, investors pulling out. He needed capital. Fast.

I slid a folder across the table.

Inside was an offer.

Not a loan.

An acquisition.

His face drained of color as he read the terms. My holding company would absorb his assets, keep the brand alive, and restructure management.

“And my position?” he asked quietly.

I met his eyes. “Consultant. Short-term.”

There was a long silence.

“You planned this,” he finally said.

“No,” I answered honestly. “You did. When you decided experience had an expiration date.”

He signed.

Within weeks, the company was restructured. Employees kept their jobs. Operations stabilized. And for the first time in years, I worked reasonable hours.

I wasn’t chasing validation anymore.

I was building something that belonged to me.

Richard left quietly, without ceremony. No revenge. No shouting. Just consequences.

Part 4 – What Time Really Gave Me

I didn’t tell many people the full story. Not because I was ashamed—but because I learned something important: the loudest success is often the weakest.

My parents passed away two years later. At my father’s funeral, I reread a note he’d written decades earlier and tucked into the bank folder.

“If he learns patience, this will change his life.”

They were right.

The money wasn’t the miracle. Time was.

I now mentor younger managers, especially those who think they’ve fallen behind. I tell them what no one told me:

Being fired doesn’t mean you failed.

Starting late doesn’t mean you’re done.

And sometimes, the most powerful moves happen quietly, over years, while everyone else is distracted.

If this story made you think differently about success, timing, or patience—share your thoughts.

Have you ever discovered something too late… or just in time?

Sometimes, the most interesting conversations begin after the ending.