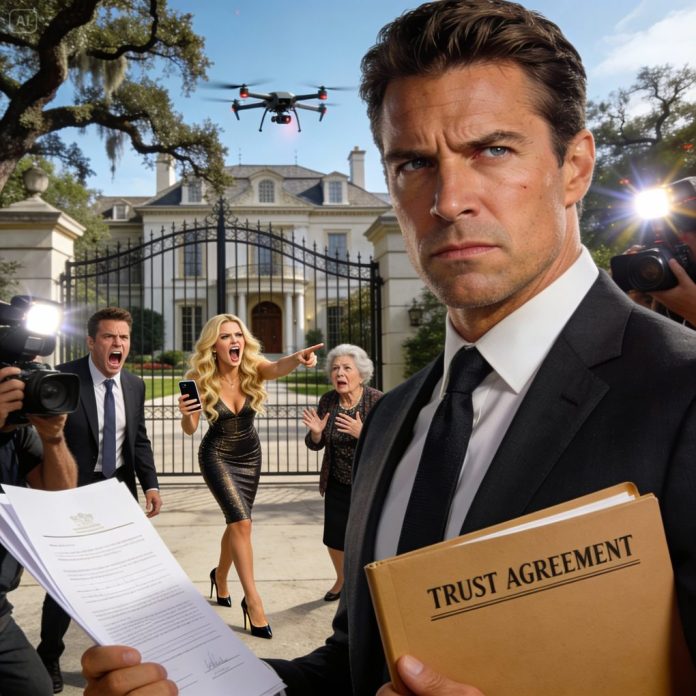

For 2 years, my family treated me like I didn’t even exist. Then a photo of my home suddenly went viral online. “We need you to sell it,” my sister snapped. “I’m drowning in debt.” I almost laughed. They thought it was just a house. They had no idea it was a ten-million-dollar mansion, locked inside a trust they would never be able to touch. And that was only the beginning of what they were about to lose.

For two years, my family treated me like I didn’t exist. No calls. No holidays together. No “How are you holding up?” after my divorce. I was the inconvenient sibling—the one who didn’t fit into their polished image of success.

My name is Ethan Caldwell, forty-one, architect by training, consultant by necessity. After my father died, the family dynamic collapsed in a quiet, cowardly way. My mother moved in with my sister. My brother stopped replying to messages. And I stayed in the house my father left me—a property most people assumed was modest, because it sat far from the city, hidden behind old trees and iron gates.

I didn’t mind the silence. I rebuilt my life slowly. I worked remotely, restored parts of the house myself, and stayed out of family drama. They didn’t ask how I was paying property taxes. They didn’t ask why I never listed the place for sale. They simply forgot me.

Until one morning, everything changed.

A drone video of my home went viral. Some real estate influencer had filmed “the most hidden private estate in the county,” estimating its value at ten million dollars. The clip exploded across social media. Comment sections speculated about the owner. News outlets reposted it.

That same afternoon, my phone rang.

It was my sister, Melissa. No greeting. No apology. Just urgency wrapped in entitlement.

“We need you to sell the house,” she snapped. “I’m drowning in debt.”

I almost laughed. Two years of silence, broken by a demand. My brother followed with a text about “family responsibility.” My mother left a voicemail reminding me of “everything they’d done for me.”

They spoke as if the house were communal property, as if I were merely holding it temporarily for them. None of them asked if I wanted to sell. None of them asked if I was okay.

What they didn’t know—what they couldn’t possibly imagine—was that the house was never really mine to sell. It was locked inside a trust my father had designed carefully, deliberately, and legally airtight.

And as I ended the call with my sister, listening to her curse me under her breath, I realized something else.

They thought this was the beginning of their rescue.

In reality, it was the beginning of everything they were about to lose.

Part 2: The Trust My Father Never Spoke About

My father, Richard Caldwell, was a quiet man. An engineer by profession, a strategist by nature. He believed in preparation more than promises, and paperwork more than emotional speeches. That was why, when he died, no one suspected there was more to his estate than what the will mentioned.

The house was listed as being transferred to me, yes—but only as a resident beneficiary. The actual ownership sat within the Caldwell Residential Trust, established five years before his death. At the time, none of us paid attention. My siblings were too busy arguing over liquid assets. I was too exhausted to fight.

The trust had rules. Clear ones.

The property could not be sold without unanimous consent from all named beneficiaries.

Any beneficiary who attempted coercion, legal pressure, or public manipulation would forfeit their claim entirely.

And perhaps most importantly: the trust included a conditional clause that activated if the property’s value exceeded eight million dollars.

That clause transferred full control to the beneficiary who had maintained continuous residence and paid all related expenses without family assistance.

That beneficiary was me.

I learned all of this during a quiet meeting with my father’s attorney, Margaret Lewis, a woman who had clearly been waiting for this moment. She slid the documents across the table calmly.

“Your father anticipated this scenario,” she said. “Public exposure changes people.”

Meanwhile, my family did exactly what the trust warned against.

Melissa contacted real estate agents and name-dropped herself as “co-owner.” My brother emailed lawyers threatening a forced sale. My mother gave a short interview to a local blog about “family conflict over inheritance,” framing me as stubborn and selfish.

Each move was documented. Each message forwarded to Margaret.

Then came the formal notice. The trust executed its clause. Ownership control transferred entirely to me. Melissa and my brother were officially removed as beneficiaries. Their shares dissolved.

The reactions were explosive. Accusations. Rage. Desperate apologies that arrived too late. Melissa showed up at my gate unannounced, crying, blaming her debt, her marriage, the economy—everything but herself.

I didn’t gloat. I didn’t yell. I simply handed her a copy of the trust summary and told her to speak to the attorney.

What hurt most wasn’t their greed. It was how predictable it all was. My father had seen it coming. He had built a system not to punish them—but to protect me.

The house, now confirmed at just over ten million dollars, was no longer the symbol they thought it was. It was proof. Proof of who stayed. Who paid. Who endured being forgotten.

And as the legal dust settled, I faced a choice of my own—one that had nothing to do with money, and everything to do with what kind of ending I wanted.

Part 3: Choosing What to Keep

After the lawyers finished and the headlines faded, the house grew quiet again. No drones. No reporters. Just the sound of wind through the trees and the slow creak of floors my father once walked on.

I could have sold it. Ten million dollars would have bought freedom in any city I wanted. But standing in the study one evening, surrounded by blueprints my father had drawn by hand, I realized something. This house was never meant to be flipped. It was meant to be held.

Instead of selling, I refinanced a portion and turned part of the estate into a private architectural retreat. A place for designers, builders, and students to work in silence, far from noise and ego. The project gained respect—not virality. And that felt right.

As for my family, the silence returned. But this time, it was different. There were no expectations attached to it. No guilt. No waiting. My mother eventually sent a letter—not asking for money, just acknowledging distance. I replied once. Kindly. Briefly.

Melissa declared bankruptcy six months later. My brother moved states. Their lives continued, just without access to something they believed they were entitled to.

I learned that being forgotten can be a strange kind of protection. When no one is watching, you see people clearly. When no one is helping, you learn what you’re capable of.

The house still stands. Quiet. Private. Unimpressed by attention. Much like my father was.

If there’s one thing this experience taught me, it’s this:

Inheritance isn’t about what you receive.

It’s about what you’re trusted to protect.

If this story made you think about family, boundaries, or the cost of being underestimated, I’d love to hear your thoughts. Sometimes the most valuable conversations start after the story ends.