“Don’t make this ugly,” she warned me.

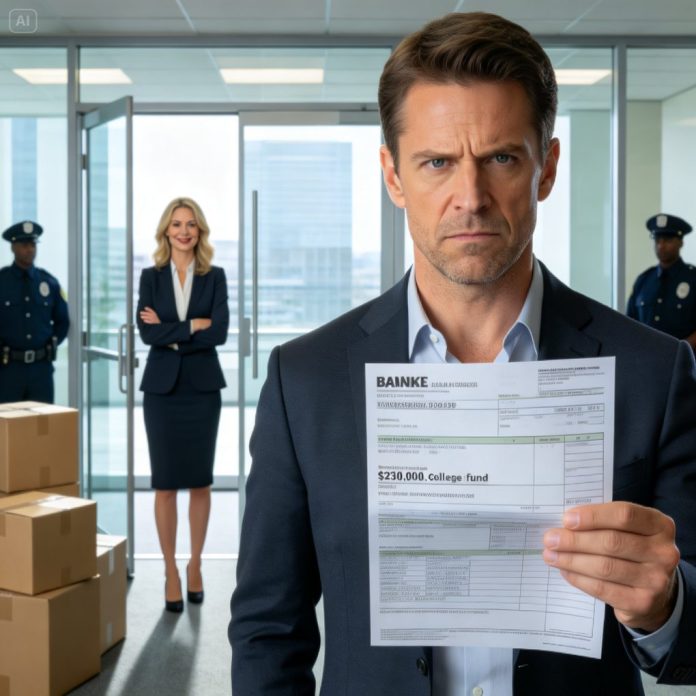

I stared at the screen, my son’s college fund drained to zero, my chest burning with disbelief. My sister did this.

When I demanded answers, she coldly replied, “You should’ve read the fine print.”

The locks on my office were changed the same day.

She thought the story ended there.

It didn’t. That was just the beginning.

PART 1 – The Transfer I Never Approved

I always believed I was careful with money. Not obsessive, not paranoid—just responsible. When you grow up watching your parents struggle, you learn early that financial security isn’t about luxury, it’s about peace of mind. That belief shaped my life, my career, and especially the future I was building for my son.

My name is Michael Lawson, and for nearly fifteen years, I ran a manufacturing consulting firm based in Ohio. It wasn’t a billion-dollar empire, but it paid well, employed good people, and most importantly, it gave me control over my time. Control mattered to me because I was a single father, and everything I did revolved around my son, Noah.

From the day he was born, I opened a college fund in his name. Every quarter, without fail, I transferred money into it. I watched it grow steadily over the years. It became my quiet reassurance that no matter what went wrong in my life, Noah would have options.

My sister, Emily Lawson, knew this.

Emily joined my company six years ago. She had an MBA, impressive credentials, and a confidence that made people assume she knew exactly what she was doing. I hired her as Director of Finance. Over time, she gained more authority, more access, more trust. She handled payroll, vendor payments, and eventually, high-level accounts. Including mine.

The first time something felt off was subtle. I noticed a delay in one of my personal transfers. When I asked Emily about it, she waved it off.

“Bank processing issue,” she said casually. “It happens.”

I believed her.

Three months later, while preparing documents for Noah’s college counselor, I logged into the account. The number on the screen didn’t register at first. I blinked, leaned closer, refreshed the page.

The balance was nearly zero.

My heart started racing. I scrolled through the transaction history. Multiple withdrawals. Large ones. Spread out just enough to avoid immediate detection.

I called the bank. They confirmed the transfers were authorized using my credentials. When I asked who had initiated them, the representative hesitated.

“Emily Lawson,” she said quietly.

I drove to the office shaking. When I confronted Emily, she didn’t deny it.

“I needed liquidity,” she said. “You’ll get it back.”

“What you took was my son’s future,” I replied.

She looked at me and said something I’ll never forget:

“You’re being emotional. This is business.”

An hour later, I was told to leave the building.

PART 2 – The Quiet Coup

Being removed from your own company doesn’t happen loudly. There are no dramatic speeches, no slammed doors. It happens through polite emails, closed meetings, and people suddenly “unavailable” to talk. By the end of that day, my access to company systems was revoked, my office reassigned, and my authority erased.

Emily had moved fast.

I later learned she had spent months preparing for this. She’d built a narrative that painted me as distracted, unstable, and financially reckless. She selectively shared internal documents with the board—documents she controlled. By the time I realized what was happening, the decision had already been made.

I was officially “removed for the good of the company.”

At home, I sat at the kitchen table long after Noah went to bed. The house felt smaller, quieter. I replayed Emily’s words over and over: This is business.

The next morning, I called a forensic accountant.

What he uncovered over the following weeks changed everything.

Emily hadn’t just accessed my son’s college fund. She’d been redirecting company money into short-term investments under shell entities, temporarily inflating quarterly performance while skimming profits for herself. The fund was just a convenient pool of liquid cash she assumed I wouldn’t monitor closely.

Every transaction had a justification. Every irregularity had a paper trail—carefully crafted by her.

I reached out to former employees. Two agreed to speak anonymously. Both had raised concerns in the past and were quietly pushed out. One of them said, “She always said you trusted her too much.”

When my lawyer filed formal discovery requests, Emily resisted. Then delayed. Then accused me publicly of retaliation. She gave interviews suggesting I was acting out of spite after losing control of the company.

For a while, it worked.

But financial records don’t lie. And patterns always repeat.

Eventually, the board demanded an independent audit. What they found forced them to confront the truth they’d ignored. The story they’d been told collapsed under its own weight.

Emily tried to settle privately. She sent a message through her attorney offering partial repayment in exchange for silence.

I refused.

“You took from my child,” I said. “There’s no quiet version of this.”

Criminal charges followed shortly after.

PART 3 – After the Exposure

The trial lasted three weeks. Long enough for the media to lose interest, but not long enough for the damage to fade. Sitting in that courtroom, listening to emails I’d once skimmed now read aloud as evidence, I felt something unexpected—not anger, but clarity.

Emily was convicted on multiple counts of fraud and misappropriation. The judge ordered full restitution, including penalties. It would take time, but Noah’s college fund would be restored.

The company survived the scandal, barely. I was offered my position back. I declined.

I no longer wanted a business built on blind trust. Instead, I started advising entrepreneurs on governance and transparency—on how to protect themselves from the very mistake I made.

Noah eventually asked me why I fought so hard.

“Because staying quiet would’ve taught you the wrong lesson,” I told him.

Family doesn’t get a free pass to betray you. And accountability isn’t revenge—it’s responsibility.

If you were in my position, would you have stayed silent to keep the peace, or would you have exposed everything, even if it meant burning bridges forever?

Sometimes, the most painful choice is the only honest one.