“My husband’s family always mocked me for my modest background, calling me ‘the girl with nothing’ at every party. When we divorced, they believed I would leave with nothing. What they didn’t know was that I was the one who had quietly built the startup under my husband’s name for tax reasons. At the final signing meeting, I placed the documents in front of them proving that I held 51% of the shares. My mother-in-law whispered, ‘What have you done?’”

Part I – The Girl With Nothing

They called me “the girl with nothing” so often that it became a private joke at family gatherings.

Not to my face at first. It began in whispers that weren’t quite soft enough. Comments about my “simple” dress sense. About how I didn’t grow up skiing in Aspen or spending summers in Provence. About how lucky I was that their son, Julian Whitmore, had chosen someone so… grounded.

Grounded was their polite word for ordinary.

Julian’s family moved in circles that valued legacy as much as liquidity. His father sat on corporate boards. His mother, Eleanor Whitmore, chaired charity galas with the precision of a military commander. Their dining table hosted senators and venture capitalists. I arrived at that table with a scholarship degree in computer science, student loans, and parents who ran a small grocery store in Ohio.

At our engagement party, Eleanor raised her champagne flute and said with a brittle smile, “We’re so pleased Julian has found someone who reminds him that money isn’t everything.”

The room laughed lightly.

I smiled too.

Because what they never bothered to ask was what I had been building long before I met their son.

Julian and I met at a tech conference in San Francisco. He had capital and connections; I had code and product vision. We talked for hours about the inefficiencies in cross-border payment systems for small businesses. I sketched an early prototype on a napkin. He said, “If you ever build this, I’ll fund it.”

A year later, I did.

We incorporated under his name for tax efficiency. His family’s advisors recommended it. “Cleaner optics,” they said. “Easier access to investors.” I was listed as Chief Operating Officer. He was CEO and majority shareholder—on paper.

Behind the scenes, I wrote the architecture. I led product development. I hired the first engineers. I negotiated early vendor contracts. When investors asked technical questions, they turned to me.

Julian was charismatic, fluent in investor language. I was fluent in systems.

The startup—LatticePay—grew faster than either of us expected. Within three years, we processed millions in monthly transactions. Venture capital flowed in. Industry publications profiled Julian as a rising fintech visionary.

At family dinners, Eleanor would beam and say, “Julian has always had such a brilliant mind.”

Then she’d glance at me and add, “And of course, Clara keeps everything… organized.”

Organized.

When the marriage began to fracture—quiet arguments about credit, about respect, about how often my contributions were framed as supportive rather than foundational—their tone sharpened.

At a Christmas party two years ago, Eleanor clinked her glass and announced, “We are so proud of Julian. From boy to businessman. Truly self-made.”

I stood beside him, holding a tray of champagne flutes, invisible.

The divorce, when it came, was polite on the surface. “Irreconcilable differences.” No public scandal. Just two signatures on a petition.

Julian assumed the division would be straightforward. The company was in his name. The Whitmore lawyers were confident. I would receive a settlement—generous by most standards. Enough to “start over.”

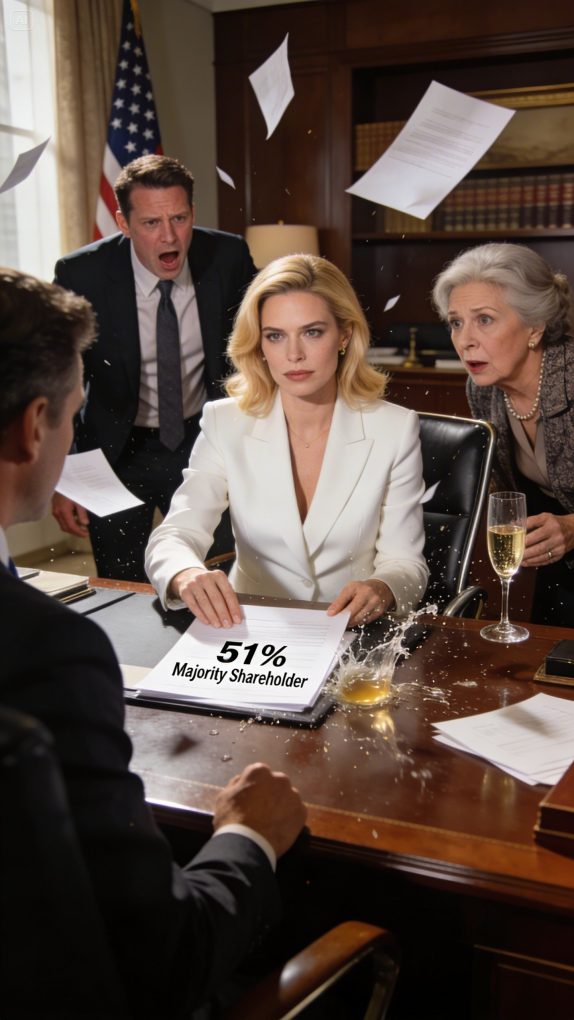

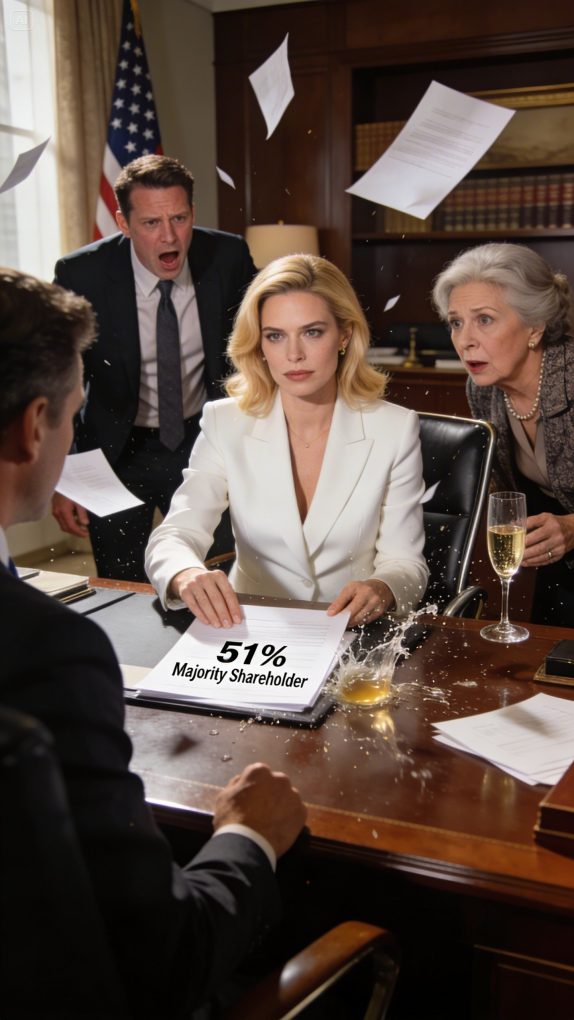

At the final signing meeting, seated across a long mahogany table from Julian, his parents, and their legal team, I placed a slim folder in front of them.

“I think there’s something you’ve overlooked,” I said calmly.

Julian frowned. Eleanor’s fingers tightened around her pen.

Inside the folder were the incorporation amendments, vesting agreements, and equity transfer documents executed two years earlier during our Series A restructuring.

Documents proving that I held 51% of LatticePay.

Eleanor’s voice came out as a whisper. “What have you done?”

Part II – Quiet Architecture

Silence spread through the conference room like a crack in glass.

Julian reached for the documents first, flipping through pages with increasing urgency. His father leaned forward, scanning the headings: Equity Reallocation Agreement. Supermajority Voting Rights. Protective Provisions.

“This isn’t possible,” Julian muttered. “I would remember signing something like this.”

“You did sign it,” I replied evenly. “During the Series A restructuring. Your attorneys recommended redistributing equity to protect against hostile takeover and to strengthen governance optics.”

Eleanor’s eyes snapped toward their lead counsel. “How did we miss this?”

The attorney adjusted his glasses, reading quickly. “The transfer was structured as a performance-based equity vesting tied to product milestones. It appears Mrs. Whitmore—” he corrected himself stiffly, “—Ms. Hayes met those milestones.”

I had insisted on that clause.

Two years earlier, when we negotiated with venture capital firms, one partner had asked bluntly, “What happens if the technical co-founder leaves?”

Julian had laughed. “She won’t.”

I had smiled but said nothing.

Later that week, I requested formal recognition of my role—not as a favor, but as governance. The compromise, suggested by their legal team, was a milestone-triggered equity vesting schedule. If product benchmarks were met—benchmarks I was solely responsible for delivering—shares would transfer incrementally.

Julian signed without reading deeply. He trusted the narrative that everything we built belonged primarily to him.

Over eighteen months, as LatticePay hit every performance target—scaling transaction capacity, securing regulatory compliance across three jurisdictions, launching enterprise integrations—the equity transferred.

Quietly.

Legally.

Meticulously documented.

I never announced it at dinner parties.

Back in the conference room, Julian’s face had lost its usual composure. “Why didn’t you say anything?” he demanded.

“Because every time I tried to assert visibility,” I said, “your family reframed it as ambition.”

Eleanor inhaled sharply. “You manipulated this.”

“No,” I corrected. “I protected myself.”

Julian’s father spoke for the first time. “If you hold 51%, that gives you controlling interest.”

“Yes.”

“And you intend to what? Seize the company?”

The word seize hung in the air, dramatic and misplaced.

“I intend to retain what I built,” I said calmly. “LatticePay is not a marital accessory. It is a company with employees, clients, regulatory obligations. I will not let it become collateral in a divorce narrative.”

Julian’s frustration flared. “So this was your plan? Marry me, build something, take control?”

The accusation would have wounded me years ago. Now it sounded tired.

“I married you because I loved you,” I said. “I built LatticePay because I believed in the product. I secured majority control because I watched how quickly I could be reduced to ‘the girl with nothing.’”

Eleanor flinched.

“That phrase,” I continued softly, “was repeated often enough that I realized something important. In your world, worth is measured by ownership. So I ensured I owned my contribution.”

Their attorney cleared his throat. “Legally, the share transfer is valid. The vesting conditions were satisfied. The board ratified the amendments.”

Julian stared at the page showing my signature alongside his. “You never corrected my parents when they said it was my company.”

“You never corrected them either,” I replied.

That was the truth neither of us had confronted. Silence can be complicity.

Eleanor’s composure began to fracture. “Do you understand what this will look like?” she asked me. “Society pages, investors, the press—”

“This is not about optics,” I said. “It’s about structure.”

I slid another document across the table: a proposed post-divorce governance plan. I wasn’t there to destroy him. I was there to clarify control.

“Julian can remain CEO,” I said. “If the board supports it. But ultimate voting power rests with majority shares. Me.”

“And if we refuse?” Julian’s father asked.

“You can challenge it in court,” I said evenly. “But discovery will surface every internal communication about credit attribution, compensation structures, and shareholder agreements. I don’t believe that benefits anyone.”

The room grew very still.

Julian leaned back in his chair, staring at the ceiling for a long moment. When he looked at me again, the anger had dulled into something more complex.

“You planned for this,” he said quietly.

“I planned for myself,” I answered.

There’s a difference.

For years, I had tolerated the subtle humiliations. The patronizing introductions. The narrative that I was fortunate to have married upward. What none of them understood was that I had been building infrastructure—legal, financial, operational—brick by brick.

Not as revenge.

As insurance.

Eleanor’s voice trembled slightly. “You’ve turned our son into a minority in his own company.”

“No,” I said. “The capitalization table did.”

And the capitalization table doesn’t care about dinner party hierarchies.

The lawyers began discussing next steps—board notifications, disclosure requirements, valuation impacts. Their voices blurred into background noise.

Julian looked at me, really looked at me, perhaps for the first time in years.

“You were never the girl with nothing,” he said quietly.

“No,” I replied. “I just never needed to announce what I had.”

Part III – Majority

The days following the meeting were measured and strategic.

A formal disclosure was sent to LatticePay’s board outlining the updated majority ownership. There was no scandal, no dramatic takeover—just paperwork processed through proper channels. The board convened an emergency session, more concerned with stability than family politics.

I presented a continuity plan.

Revenue was strong. Regulatory compliance was intact. Key partnerships were secure. I made it clear that my intention was not to destabilize operations but to formalize governance in a way that reflected actual contributions.

Some board members had suspected the imbalance for years. In private conversations, more than one had remarked, “You’re the one who understands the product.” But they had deferred to the visible narrative—the charismatic CEO, the prestigious last name.

Now the structure matched the reality.

Julian remained CEO, though under revised performance metrics approved by the board. I assumed the role of Executive Chair, overseeing long-term strategy and holding final voting authority.

The media coverage was restrained. A fintech blog ran a headline: Co-Founder Secures Majority Stake in Post-Divorce Restructuring. The society pages remained silent. There was no appetite for a public feud.

Privately, the shift was seismic.

At the first board meeting after the announcement, I sat at the head of the table. Not triumphantly. Simply correctly positioned.

Julian presented quarterly results. When questions arose about scaling into a new international market, he paused and glanced at me—not for permission, but for alignment.

That subtle difference mattered.

Weeks later, Eleanor requested to meet me alone.

We chose a quiet café, far removed from gala ballrooms and private clubs.

She arrived impeccably dressed, as always, but there was a new fragility in her posture.

“I underestimated you,” she said without preamble.

“Yes,” I agreed gently.

She winced, perhaps expecting deflection.

“I thought resilience looked like polish,” she continued. “You didn’t have our polish.”

“I had my own,” I said.

She stirred her tea, eyes lowered. “When I said those things… about your background… I thought I was protecting our family’s standards.”

“And now?” I asked.

“Now I see you were protecting yourself from us.”

It wasn’t an apology wrapped in tears. It was something rarer—recognition.

“I never wanted your son diminished,” I said. “I wanted acknowledgment.”

Eleanor looked up at me, truly studying my face. “And if you hadn’t secured control?”

“Then I would have walked away with the settlement you offered,” I said honestly. “And LatticePay would have continued under a narrative that erased me.”

She nodded slowly. “You built it.”

“Yes.”

Months passed. LatticePay expanded cautiously—sustainably. We prioritized compliance over aggressive projections. Investor confidence stabilized. Internally, the culture shifted. Credit became explicit. Contributions were documented. Titles matched responsibility.

One evening, after a particularly long strategy session, Julian lingered in the conference room.

“Do you ever regret how it ended?” he asked.

“The marriage?” I clarified.

He nodded.

“I regret that we let other voices define us,” I said. “But I don’t regret securing what I built.”

He gave a faint smile. “You were always the stronger one.”

“Strength isn’t loud,” I replied. “It’s consistent.”

As I left the office that night, I thought back to all those parties where I stood beside Julian while being described as fortunate, simple, lucky.

They had mistaken modest beginnings for absence.

They had mistaken silence for emptiness.

They had mistaken support for insignificance.

The truth was far less dramatic and far more powerful: ownership doesn’t require applause. It requires foresight.

If you’ve ever been underestimated because of where you started, ask yourself this—are you building quietly, or are you waiting for recognition? Sometimes the most decisive moment isn’t when you argue at the table. It’s when you place documents down and let structure speak for you.

So tell me—if the narrative around you collapsed tomorrow, would the paperwork reflect the truth of your contribution?