“My in-laws constantly belittled me for coming from an ordinary background, calling me ‘the girl who has nothing’ at every gathering. When the divorce happened, they were sure I would walk away empty-handed. What they didn’t realize was that I had secretly built the startup registered in my husband’s name for tax purposes. At the final paperwork signing, I set down documents showing I owned 51% of the company. My mother-in-law murmured, ‘What have you done?’”

Part 1: The Girl Who Had Nothing

They never bothered lowering their voices.

At Sunday dinners in the sprawling Whitmore estate, crystal glasses chimed and silverware gleamed under chandeliers imported from Italy. And somewhere between the second course and dessert, my mother-in-law, Eleanor Whitmore, would lean back in her chair and say with a thin smile, “Well, not everyone grows up with… advantages.”

Her eyes would flick toward me.

I was “the girl who has nothing.” The scholarship student from a public university. The daughter of a high school math teacher and a mechanic. The one who didn’t summer in Tuscany or discuss hedge funds over brunch.

I met Andrew Whitmore at a tech networking event in Chicago. He was charismatic, confident, effortlessly polished. I was the operations consultant quietly fixing inefficiencies for early-stage companies. We built something real together—at least, I believed we did.

Two years into our marriage, Andrew wanted to launch a logistics software platform targeting mid-sized manufacturers. He had the connections; I had the technical and operational blueprint. For tax efficiency and investor optics, the company—HelixGrid—was registered in his name. His family’s attorneys recommended it.

“It’s just paperwork,” Andrew had said at the time. “We’re married. It’s ours.”

I didn’t argue. I built.

I drafted the product roadmap. I negotiated with developers overseas. I pitched to early clients while Andrew leveraged his family name to secure seed funding. When Eleanor toasted her son at family gatherings—“To Andrew, the visionary behind HelixGrid”—I smiled and passed the wine.

Behind the scenes, I structured everything carefully.

Because I had grown up with nothing, I understood the cost of vulnerability.

The marriage began unraveling in our fourth year. Success magnified Andrew’s worst instincts. He grew impatient, dismissive, intoxicated by praise. Arguments shifted from strategic disagreements to personal attacks. He began referring to the company as “my company” in public.

The final fracture came quietly: a late-night argument about control, about my “overstepping.” He told me I was lucky to be along for the ride.

Three months later, I filed for divorce.

His family assumed I would leave with a modest settlement—perhaps a condo and a check. After all, the startup was legally his.

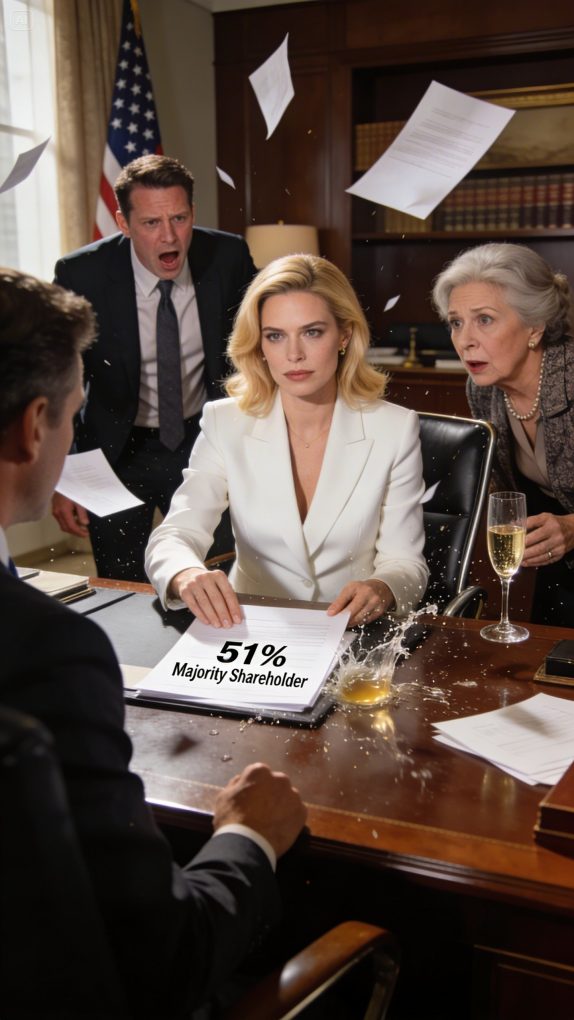

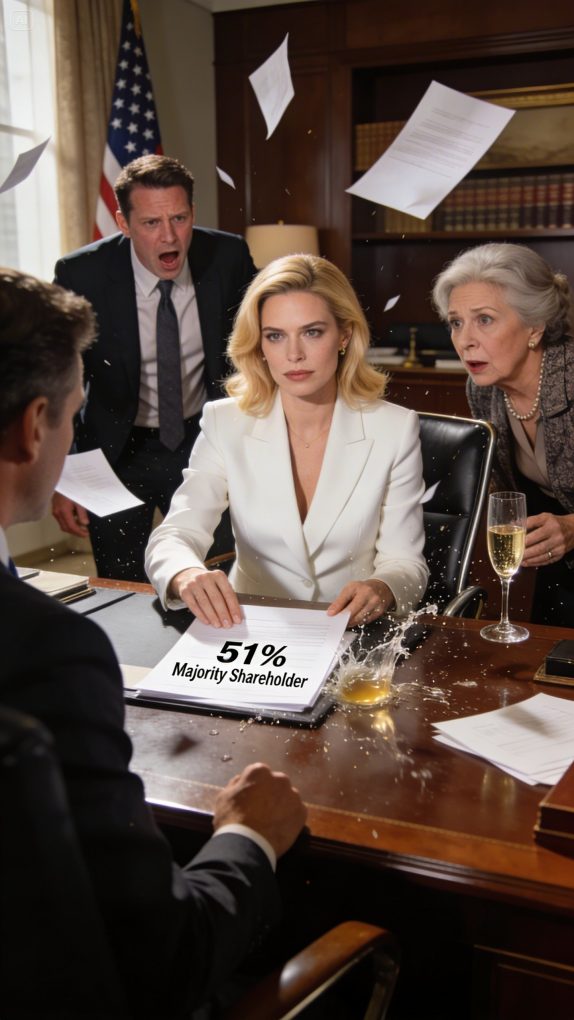

At the final paperwork signing, in a glass-walled conference room overlooking downtown, Andrew sat across from me with his attorney. Eleanor sat beside him, posture rigid, lips pursed in restrained disdain.

I placed a folder on the table.

“I think there’s been a misunderstanding,” I said calmly. “About what belongs to whom.”

I slid across a stack of documents: shareholder agreements, convertible note structures, amended equity allocations executed two years prior.

The silence thickened as their attorney scanned the pages.

Eleanor’s composure faltered. “What have you done?” she murmured.

I met her gaze evenly.

“I made sure the girl who has nothing built something of her own.”

Part 2: The Architecture of Ownership

Shock is a fascinating thing. It moves across a face in stages—confusion, disbelief, calculation.

Andrew’s attorney flipped through the documents twice before speaking. “These amendments… when were they executed?”

“Eighteen months ago,” I replied. “Filed with the state. Notarized. Reflected in the cap table and acknowledged in the investor update from Q3 of that year.”

Andrew’s head snapped toward me. “That was administrative cleanup. You said it was standard structuring.”

“It was,” I said. “Standard structuring to protect intellectual property and operational equity.”

Here’s what they hadn’t realized: while HelixGrid was registered under Andrew’s name initially, I had insisted on formalizing my role once revenue began scaling. Investors had required clearer delineation of executive responsibilities. I drafted the revised operating agreement myself—assigning 51% of voting shares to the Chief Operating Architect.

Me.

Andrew had signed the amendment without reading past the summary page. His family’s attorneys were focused on tax efficiencies and investor relations; they trusted internal governance to Andrew.

And Andrew trusted me.

Not out of respect—but out of assumption.

The truth was, I never acted out of revenge or suspicion. I acted out of prudence. I had watched my mother calculate grocery budgets down to the dollar. I had seen my father injured at work with no financial cushion. Security was never abstract to me.

When HelixGrid secured its Series A funding, I structured the equity dilution carefully. My 51% majority became 38% post-funding—but Andrew’s fell proportionally. Control remained with me due to voting rights embedded in the operating agreement. Protective provisions required my signature for any sale, merger, or major restructuring.

All legal. All documented.

Andrew’s attorney cleared his throat. “Mrs. Whitmore—technically, Ms. Carter—holds majority voting control under the current governance structure.”

Eleanor stiffened. “That’s impossible. The company was Andrew’s.”

“It was registered in his name,” I corrected gently. “Ownership evolved.”

Andrew leaned forward, anger simmering. “You manipulated this.”

“I negotiated it,” I replied. “You were busy courting investors and speaking at conferences. Someone needed to protect the operational core.”

The divorce settlement documents sitting between us suddenly looked outdated.

Andrew had entered the room confident. HelixGrid was valued at nearly $40 million following aggressive growth over the past year. He assumed I would receive a fraction based on marital asset division. Instead, he was facing the reality that he was minority to the woman his family dismissed.

“This is extortion,” Eleanor hissed.

“No,” I said evenly. “This is structure.”

The irony was sharp but not satisfying. I felt no triumph—only clarity.

Over the following weeks, negotiations shifted dramatically. Andrew’s legal team proposed buyouts, restructuring, dilution strategies. But protective clauses prevented unilateral changes. Any sale required my consent. Any new issuance required board approval—on which I held decisive voting power.

Board members, many of whom worked closely with me on operations, were not surprised. They knew who built the backend architecture, who stabilized churn rates, who renegotiated vendor contracts when margins tightened.

In private, one investor told me, “We always knew you were the backbone.”

Backbone. Not ornament.

Andrew and I eventually reached a settlement: I retained controlling interest and remained CEO. He accepted a reduced equity stake and a buyout package over time, contingent on non-interference. Publicly, the transition was framed as “leadership realignment.” Privately, it was a recalibration of power.

At the final signing session, Andrew looked tired—less furious, more reflective.

“You planned for this,” he said quietly.

“I planned not to disappear,” I answered.

Eleanor said nothing. For the first time since I had known her, she looked uncertain—not about money, but about narrative. The story she told about me no longer fit the facts.

When the ink dried, HelixGrid was no longer “Andrew’s company.”

It was mine to lead.

Part 3: Redefining Value

Control is not revenge. It is responsibility.

The months following the divorce were the most demanding of my professional life. Rumors circulated quietly through industry circles. Some assumed scandal. Others assumed I had outmaneuvered Andrew ruthlessly. I refused to engage publicly. Results would speak louder.

As CEO, I restructured HelixGrid’s growth strategy. Andrew had favored rapid expansion—new verticals, aggressive hiring, bold projections. I favored sustainability. We optimized our core manufacturing clients, improved platform stability, and reduced customer acquisition costs by refining referral pipelines.

Revenue growth slowed slightly—but profitability increased.

Internally, I implemented transparent reporting structures. Every department head had access to quarterly financials. Incentives were tied to long-term retention rather than short-term spikes. We built a culture where credit was distributed, not concentrated.

One evening, after a board meeting in which we approved international expansion under cautious modeling, an investor lingered.

“You’ve changed the tone of this company,” he said.

“How?” I asked.

“It feels… grounded.”

Grounded.

Perhaps that was the difference between Andrew and me. He had grown up with safety nets; risk felt exhilarating. I had grown up without them; risk felt calculated.

Six months after the divorce finalized, HelixGrid was featured in a business journal—not for drama, but for disciplined growth under new leadership. My name appeared in print as Founder and CEO.

Eleanor attended a charity gala that same month. We crossed paths near the entrance, cameras flashing nearby.

She studied me carefully before speaking. “I misjudged you.”

It wasn’t quite an apology. But it was honest.

“I never needed your approval,” I replied softly. “Only your accuracy.”

She gave a small, reluctant nod.

The label “the girl who has nothing” no longer clung to me. Not because I had acquired wealth—but because I had redefined worth.

I sometimes reflect on that conference room moment—the papers sliding across the table, the disbelief, the murmured question: What have you done?

What had I done?

I had refused to build invisibly. I had refused to equate love with dependency. I had refused to mistake registration for ownership.

The startup was never secretly built to trap anyone. It was built because I believed in the product, in the work, in the long nights refining code and negotiating contracts. Protecting my stake was not deceit; it was self-respect.

Divorce did not leave me empty-handed.

It left me clear-eyed.

If you’ve ever been underestimated because of where you started, remember this: background is context, not destiny. Structures matter. Documentation matters. Quiet diligence matters.

And sometimes, the person labeled as having nothing is simply the one who understands value most deeply.

So tell me—if the world underestimated you tomorrow, what foundation would you already have in place?